city of richmond property tax inquiry

Education and Human Services Standing Committee Meeting - September 8 2022 at 200. Electronic Check ACHEFT 095.

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Circuit Court Clerk for the City of Richmond VA.

. You can also purchase Tax certificates in. Informal Formal Richmond City Council Meetings - September 12 2022 at 400 pm. Richmond City collects on average 105 of a propertys assessed.

Selecting options for consulting taxes. 295 with a minimum of 100. While our partners work directly with the Treasurer to provide resources or link our ambassadors to the community.

Finance Taxes Budgets. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value.

My Business License. Other Services Adopt a pet. Virginia Judiciary Online Payment System VJOPS.

Access City of Virginia Official Website. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. City of Richmond Real Estate Search Program.

Real Estate and Personal Property Taxes Online Payment. Understanding Your Tax Bill. Real Estate taxes are assessed as of January 1 st of each year.

To pay your 2019 or newer property taxes online visit. Manage Your Tax Account. Billing is on annual basis and payments are due on December 5 th of each year.

Search by Property Address Search. City of Richmond ID. In Person at City Hall.

The City Assessor determines the FMV of over 70000 real property parcels each year. Real Estate Taxes are assessed on all land buildings and any other improvements attached to the land and completed as of January 1 st of each tax year. If you are interested in serving as an Ambassador or Partner please.

Due Dates and Penalties for Property Tax. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Property Tax Vehicle Real Estate Tax.

Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. Late payment penalty of. Drop Box at City Hall.

To avoid late payment penalties taxes must be received in the Property Tax Department at City Hall on or before July 4 2022. If you do not pay your property taxes on time in full you will be. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

1 View Download Print and Pay Richmond VA City Property Tax Bills.

Detroit Suing 700 Property Investors For Unpaid Taxes Http Www Crainsdetroit Com Article 20170829 News 637586 De Property Investor Real Estate Humor Property

Property Tax Billings City Of Richmond Hill

:format(webp)/https://www.thestar.com/content/dam/localcommunities/newmarket_era/news/2022/08/17/update-here-is-your-opportunity-to-own-a-piece-of-property-in-markham-for-only-five-figures/10628904_forsale.jpg)

Update Here Is Your Opportunity To Own A Piece Of Property In Markham For Only Five Figures The Star

Property Assessments City Of Mission

Municipal Property Assessment Mpac City Of Richmond Hill

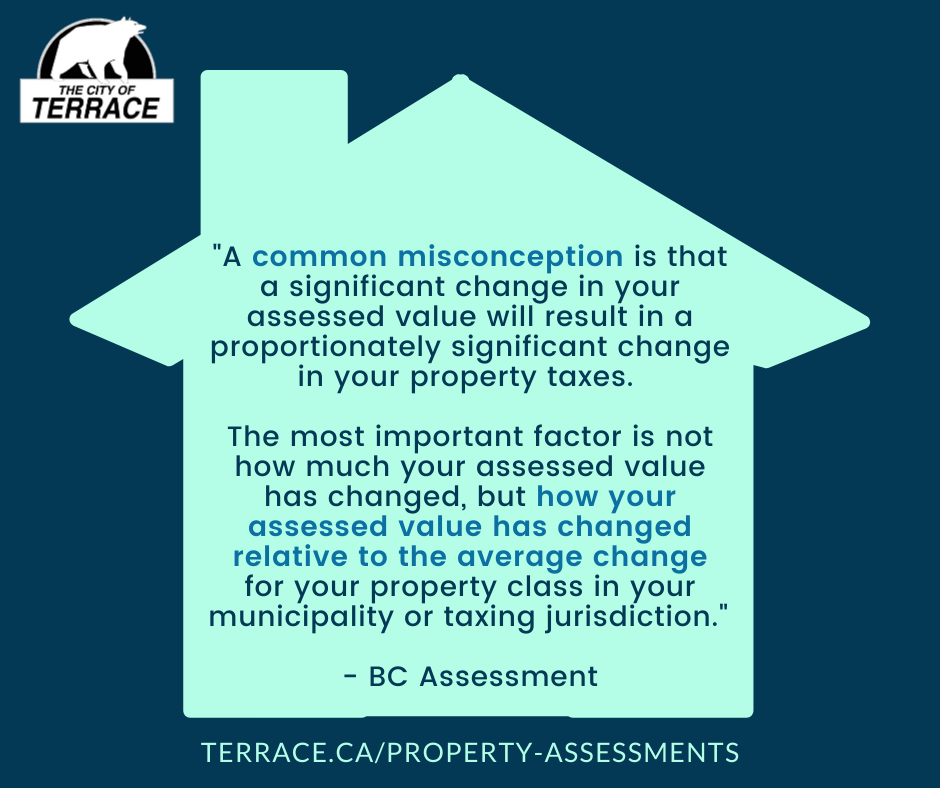

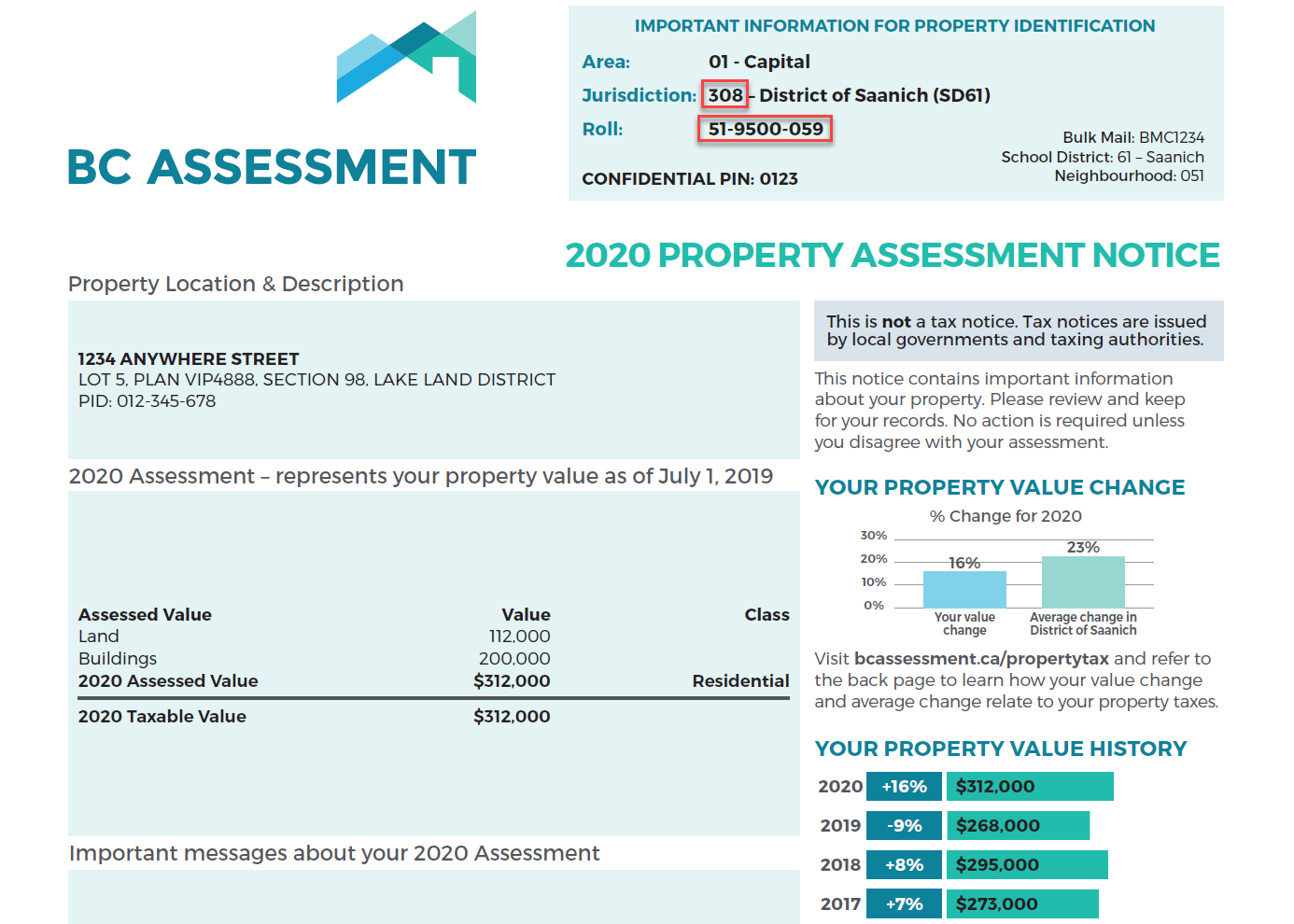

Property Assessments City Of Terrace

:format(webp)/https://www.thestar.com/content/dam/thestar/business/personal_finance/2010/09/07/property_tax_10_things_you_need_to_know/the_take_on_the_taxhike.jpeg)

Property Tax 10 Things You Need To Know The Star

Linxprint Com On Twitter Pop Up Banner Marine Search And Rescue Southern Region

Where Do I Find My Folio Number And Access Code Myrichmond Help

Where Do I Find My Folio Number And Access Code Myrichmond Help

Northern Bc Region Property Assessments

Preston Hollow Home Architect House Architect House Styles

Paying Your Property Tax City Of Terrace

How 15 Canadian Cities Got Their Names Infographic Infographic City Canadian

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Property Assessment Assessment Search Service Frequently Asked Questions